The smart Trick of Frost Pllc That Nobody is Talking About

The smart Trick of Frost Pllc That Nobody is Talking About

Blog Article

Fascination About Frost Pllc

Table of ContentsA Biased View of Frost PllcAn Unbiased View of Frost PllcThe Greatest Guide To Frost PllcThe Basic Principles Of Frost Pllc Get This Report on Frost Pllc

CPAs are among the most trusted occupations, and for good reason. Not just do CPAs bring an unparalleled level of understanding, experience and education to the process of tax planning and handling your money, they are especially educated to be independent and unbiased in their work. A CPA will assist you secure your interests, listen to and resolve your worries and, similarly vital, provide you satisfaction.In these defining moments, a certified public accountant can provide even more than a general accountant. They're your relied on expert, guaranteeing your organization stays financially healthy and balanced and legitimately protected. Hiring a regional certified public accountant firm can favorably affect your service's economic wellness and success. Here are five key benefits. A local certified public accountant company can help in reducing your service's tax obligation burden while making certain conformity with all relevant tax obligation laws.

This growth shows our devotion to making a favorable effect in the lives of our customers. Our dedication to excellence has been recognized with multiple distinctions, including being called among the 3 Best Bookkeeping Companies in Salt Lake City, UT, and Best in Northern Utah 2024. When you function with CMP, you end up being component of our family members.

9 Simple Techniques For Frost Pllc

Jenifer Ogzewalla I've worked with CMP for numerous years currently, and I've truly valued their knowledge and performance. When auditing, they function around my routine, and do all they can to preserve connection of workers on our audit.

Below are some key concerns to direct your choice: Examine if the CPA holds an active license. This guarantees that they have actually passed the necessary examinations and fulfill high honest and specialist requirements, and it reveals that they have the certifications to manage your monetary issues responsibly. Confirm if the certified public accountant offers solutions that straighten with your business needs.

Tiny services have special economic demands, and a CPA with relevant experience can supply more customized recommendations. Ask concerning their experience in your sector or with services of your dimension to ensure they comprehend your certain challenges.

Make clear how and when you can reach them, and if they offer routine updates or consultations. An available and receptive CPA will certainly be vital for prompt decision-making and support. Working with a regional certified public accountant firm is more than simply outsourcing economic tasksit's a clever financial investment in your company's future. At CMP, with workplaces in Salt Lake City, Logan, and St.

Our Frost Pllc PDFs

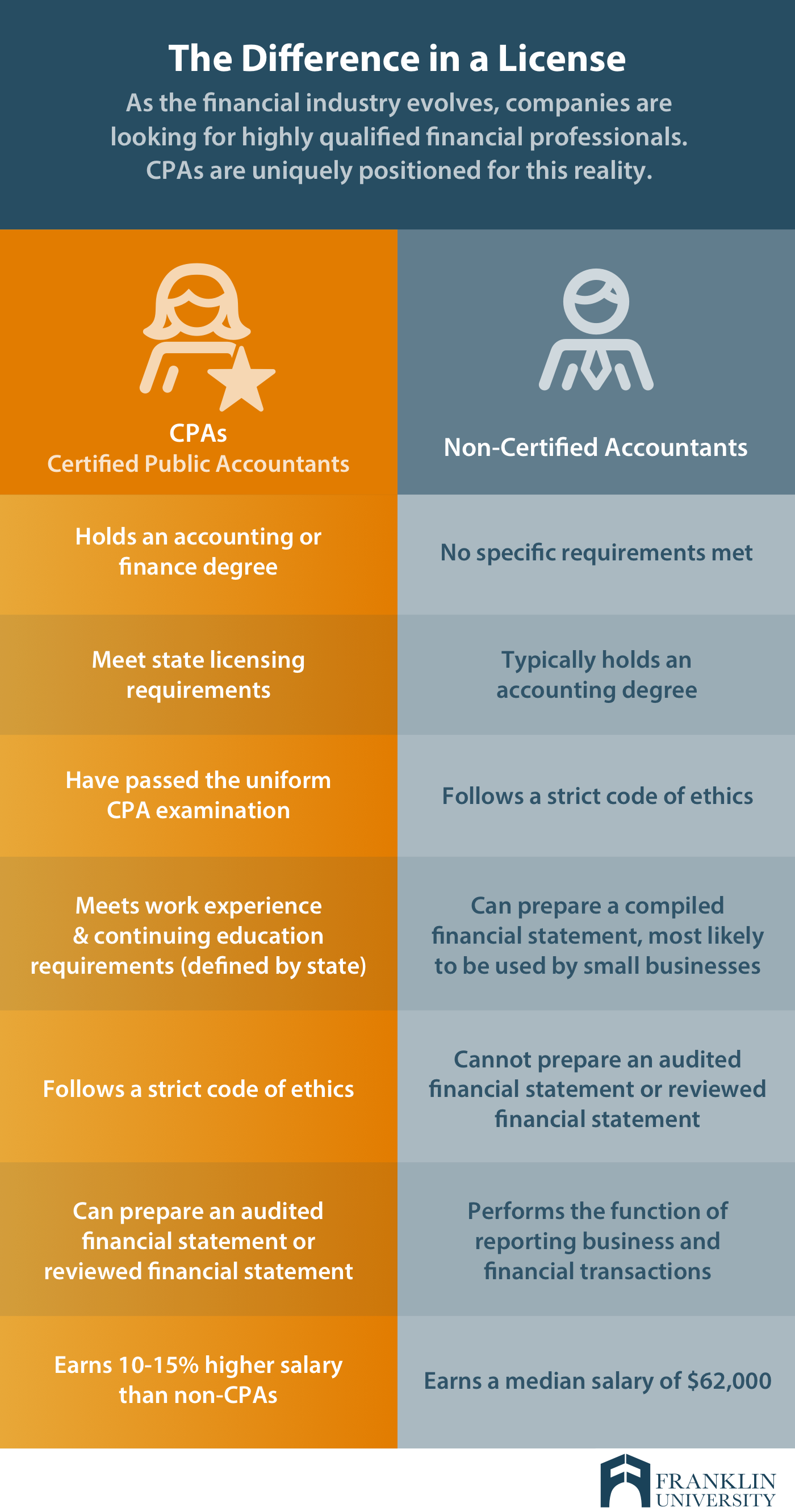

An accounting professional that has actually passed the CPA exam can represent you before the internal revenue service. CPAs are licensed, accounting experts. Certified public accountants might benefit themselves or as component of a company, depending on the setup. The expense of tax prep work might be reduced for independent specialists, yet their knowledge and capability may be much less.

The Basic Principles Of Frost Pllc

Taking on this responsibility can be an overwhelming task, and doing glitch can cost you both economically and reputationally (Frost PLLC). Full-service certified public accountant firms know with filing demands to click for info guarantee your company adhere to federal and state laws, in addition to those of financial institutions, capitalists, and others. You might require to report extra earnings, which may need you to file an income tax return for the very first time

CPAs are the" large guns "of the accountancy market and typically don't deal with daily accounting tasks. Typically, these various other types of accounting professionals have specialties throughout locations where having a CPA certificate isn't called for, such as administration audit, not-for-profit bookkeeping, price accounting, government audit, or audit. As a result, making use of an accounting solutions business is typically a far much better worth than hiring a CERTIFIED PUBLIC ACCOUNTANT

firm to support your sustain financial recurring monetary.

Brickley Wide Range Monitoring is a Registered Investment Consultant *. Advisory services are just used to clients or possible clients where Brickley Riches Management and its agents are appropriately accredited or exempt from licensure. The information throughout this web site is entirely for educational purposes. The web content is developed from resources thought to offer precise information, and we perform practical due diligence evaluation

however, the information contained throughout this internet site is subject to alter without notice and is not devoid of error. Please consult your financial investment, tax obligation, or legal expert for support concerning your specific situation. Brickley Wide Range Monitoring does not provide legal advice, and nothing in this internet site will he said be construed as legal recommendations. To learn more on our firm and our advisors, please see the current Kind ADV and Part 2 Sales Brochures and our Customer Partnership Recap. The not-for-profit board, or board of directors, is the lawful governing body of a not-for-profit organization. The members of a not-for-profit board are in charge of recognizing and applying the lawful needs of an organization. They additionally concentrate on the top-level technique, oversight, and responsibility of the organization. While there are many candidates deserving of signing up with a board, a CPA-certified accounting professional brings a special skillset with them and can act as a useful resource for your not-for-profit. This firsthand experience gives them insight into the habits and techniques of a strong managerial team that they can after that show to the board. Certified public accountants likewise have knowledge in creating and refining organizational plans and procedures and assessment of the practical needs of staffing models. This provides the one-of-a-kind skillset to evaluate management teams and supply suggestions. Key to this is the capacity to comprehend and translate the nonprofits'annual financial declarations, which supply insights right into just how a company produces profits, exactly how much it costs the organization to run, and how successfully it handles its contributions. Usually the monetary lead or treasurer is charged with handling the budgeting, forecasting, and testimonial and oversight of the financial details and monetary systems. Among the benefits of being an accounting professional is working very closely with members of various organizations, consisting visit this web-site of C-suite execs and various other decision manufacturers. A well-connected certified public accountant can take advantage of their network to aid the organization in numerous calculated and speaking with duties, effectively connecting the company to the optimal prospect to satisfy their demands. Next time you're seeking to fill a board seat, consider getting to out to a CPA that can bring value to your company in all the means provided above. Desire to discover more? Send me a message. Clark Nuber PS, 2022.

Report this page